Dubai Company Expert Services - Questions

Wiki Article

Some Of Dubai Company Expert Services

Table of ContentsThe smart Trick of Dubai Company Expert Services That Nobody is Talking AboutThe Ultimate Guide To Dubai Company Expert ServicesAbout Dubai Company Expert ServicesIndicators on Dubai Company Expert Services You Need To KnowDubai Company Expert Services for Dummies

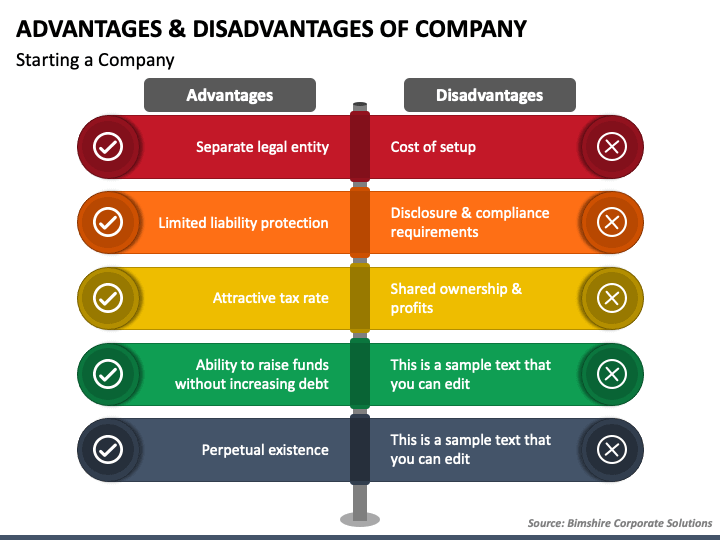

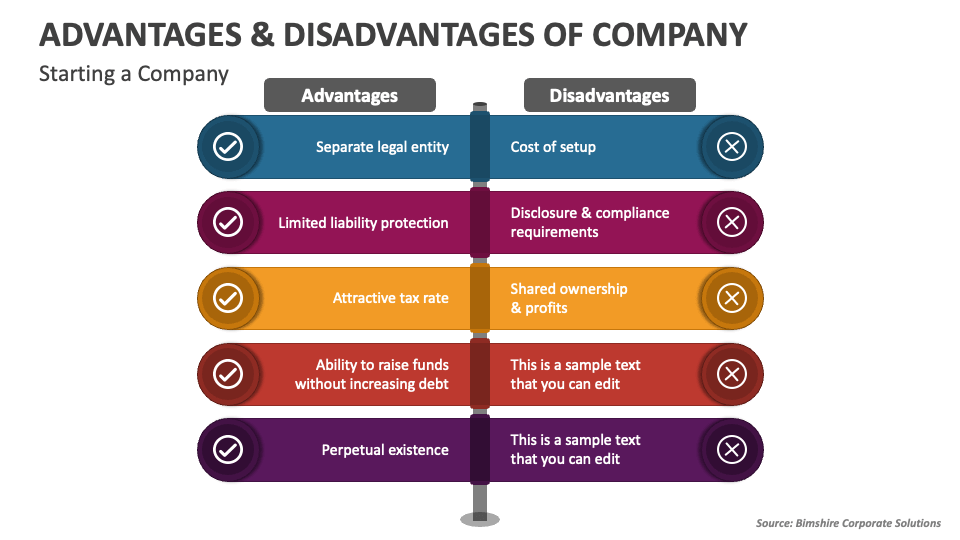

If one shareholder has greater than 25 percent of the shares, they are dealt with in company law as 'persons of substantial interest' since they can affect decisions made concerning the business. Personal restricted business supply a number of essential advantages compared to companies operating as sole traders. As a single investor, you are personally responsible for all the financial debts and obligations of your service.That minimizes the threat of having your personal assets took to pay for the financial debts of business if it fails. Associated: Every little thing you need to recognize about Lenders as well as Debtors A private restricted company is perceived as more substantial than businesses run by a single investor. When clients put orders or honor agreements, they wish to be positive that the supplier has the resources to offer a dependable solution.

Related: What is EIS? - alternative funding choices for small companies Associated: What is SEIS? - Alternate little company funding Sole traders pay income tax obligation and also National Insurance policy payments on the revenues of business through an annual self-assessment income tax return. Dubai Company Expert Services. The price of revenue tax obligation and National Insurance contributions amounts that of a personal individual and also includes the same individual allowances.

You can likewise raise capital by offering shares in your business, although you can not provide them for public sale. Associated: An overview to crowdfunding and also the best crowdfunding sites UK When you register your company name with Business Home, the name is shielded and can not be utilized by any type of various other service.

The Only Guide for Dubai Company Expert Services

If Business Residence identify a coordinating name or a name that is very comparable, they will suggest business as well as decline to grant consent. This level of protection makes it tough for various other firms offering copies of your products can not 'pass-off' their items as real. Related: Legal aspects of beginning a small company.As dividends are taxed at a lower rate, this will certainly reduce your tax obligation bill and also provide a much more tax obligation reliable approach of commission contrasted with salary alone. There are likewise various other means to take cash out of the service as a supervisor, including perk payments, pension plan contributions, supervisors' loans as well as exclusive investments.

Sole investors do not have the very same adaptability. They take revenue from the earnings of the business and the revenue is tired at basic personal income rates. Connected: Determining tax obligation on returns: An overview & example In a minimal company, you might be able to make use of a firm pension plan scheme As spending funds in a private personal pension plan scheme.

8% as well as its per head GDP in 2015 is approximated at greater than $80k. Its gross national financial savings are nearly 50% of its GDP. It exports almost S$ 500 billion well worth of exports every year so this country with only 5. 25 million people has actually amassed the 10th biggest foreign money gets on the planet.

Top Guidelines Of Dubai Company Expert Services

The personal tax rate begins at 0%, climbs very progressively to an optimum see this here of 20% for revenues over S$ 320,000. Company revenues are not double tired when they are passed to investors as dividends. To put it simply, rewards are dispersed to shareholders tax-free. Finally, Singapore bills among the most affordable value added tax prices worldwide.These contracts are made to ensure that economic purchases in between Singapore as well as the treaty country do not endure from double tax. Singapore supplies Unilateral Tax obligation Credit scores (UTCs) for the instance of countries with which it does not have a DTA - Dubai Company Expert Services. Hence, a Singapore tax resident firm is very not likely to suffer from double taxes.

You do not need any kind of regional partners or investors - Dubai Company Expert Services. This enables you to start a firm with the kind of resources framework that you prefer as well as distribute its ownership to suit your investment requirements. Additionally, there are no limitations on the amount of capital that you can bring from your home country to invest in your Singapore company.

No tax obligations are enforced on capital gains from the sale of an organization. Similarly, no tax is imposed on rewards paid to the shareholders. Singapore does not impose any type of constraints on the activity of foreign currency into or out of the country. This frictionless motion of funds throughout boundaries can give severe flexibility to a service.

Dubai Company Expert Services Things To Know Before You Buy

Singapore has among one of the most reliable and bureaucracy-free regulatory frameworks in the world. For 9 successive years, Singapore has placed top on World Bank's Convenience of Working study. The needs for integrating a business are simple and also the treatment for doing so is basic. It takes much less than a day to integrate a new firm in most instances.

The port of Singapore is one of the busiest in the entire globe And also is click here for more info classified as a major International Maritime. Singapore's Changi Airport terminal is a world class airport terminal that provides to around 20 million passengers annually and also offers hassle-free flights to nearly every significant city in globe.

Singaporeans are some of the most productive and well qualified workers worldwide. The nation's outstanding education and learning system produces a workforce that is proficient at what it does, yet on salaries it is incredibly affordable with other nations. Singapore is viewed generally following, well-functioning, contemporary and straightforward nation.

By finding your company in Singapore, you will signify professionalism and also high quality to your clients, partners and distributors. The initial impression they will certainly have of your company will be that of an expert, skilled, sincere, and also well-run company.

Our Dubai Company Expert Services PDFs

Think about the following: The legal rights as well as legal responsibilities of those that take component in business Who regulates the business as well as the degree of control you wish to have How complex you desire the firm's framework to be The lifespan of business The financial resources, including tax obligations, financial debt, as well as liabilities Your over considerations will determine the sort of company you'll develop, but you must most likely obtain lawful recommendations on the most effective kind of firm for your circumstance.

This is one of the easiest methods to start a service and also the most typical kind of company. In this kind of configuration, individuals may equally split the more helpful hints profits and also losses as well as take on the liability, unless a composed contract specifies how these points are to be shared.

Report this wiki page